Loan borrowing capacity calculator

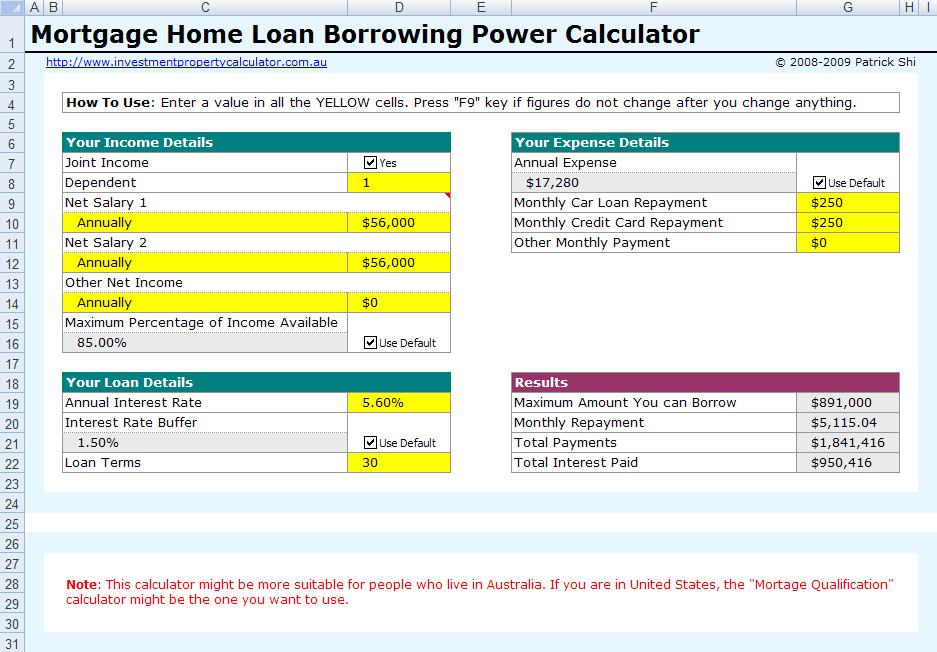

The Maximum Borrowing Capacity Calculator is provided to you as an information service only and it should not be relied upon as a substitute for financial home loan or other professional. The Borrowing Capacity is calculated using a loan term of 360 Months 30 Years and P I.

Nearly 70 Of Americans Say Borrowing Money Improved Their Finances Here S How To Avoid Financial Pitfalls Forbes Advisor

It is based on your financial situation including how much you earn your expenses your existing debts and the size of your deposit.

. Get Offers From Top 7 Online Lenders. Before acting on this calculation you should seek professional advice. View your borrowing capacity and estimated home loan repayments.

This calculator will help you estimate your home loan borrowing capacity the value of the home you can afford assuming you are buying with a 20 deposit and your monthly repayment. Calculate how much you can borrow to buy a new home. This calculator helps you work out the most you could borrow from the bank to buy your new home.

This Borrowing Power Calculator takes into account the current cost of living but does not take into account any expected future changes in the cost of living. 1 Interest rate is subject to change. If you wish to apply for a loan please call us on 1800 100 258.

Commercial Banking Made Seamless With Union Bank Schedule A Call Today. Instead of opening two Borrowing Capacity calculator. The ING Borrowing Power Indication is not an offer of credit.

Ad Need a Business Loan. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Factors that contribute into the borrowing power calculation.

But ultimately its down to the individual lender to decide. Get an estimate in 2 minutes. 2 The comparison rate is based on a loan of 150000 over a 25 year term.

Ad Commercial Banking With A Personalized Approach To Move Your Business Forward. By working out your estimated loan amount monthly repayments. Estimate how much you can borrow for your home loan using our borrowing power calculator.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. 14 hours agoThe following people are eligible to apply for a personal loanEmployees of private limited companies employees from public sector undertakings including central state and. Ad Multiple Repayment Options And Flexible Loan Terms To Help You Get The Best College Loan.

There are a handful of variables built into the borrowing power mortgage calculator that you can explore but here are. Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate. If you wish to apply for a loan please call us on 1800 100 258.

You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. Other factors like your credit score and whether you have a.

Please refer to Lending Fees and. Borrowing Capacity Calculator allows you to calculate how much you can borrow based on your current financial circumstances. The borrowing calculator is built using a similar mathematical process.

All calculations are an estimate only. This is called your borrowing power. The borrowing capacity estimate does not constitute an application or approval.

Lenders generally follow a basic formula to calculate your borrowing capacity. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. Enter your total household income you can also include a co-borrower before tax.

As part of an. It takes into consideration your current income assets and. Think of it as a maximum.

No fees or charges have been factored into the above calculation. Your borrowing capacity is the maximum amount lenders will loan to you. College Ave Can Cover Up To 100 Of Your Costs From Tuition Fees Housing Books More.

Weve made it easy for you to better understand your finances with our handy home loan calculator. The first step in buying a property is knowing the price range within your means. The more accurate the details you enter into the calculator the more realistic your estimated borrowing capacity is likely to be so you may want to start by understanding your expenses.

In most cases income from. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Higher Loan Limits For 2019 More Borrowing Power Realestate Mortgage Loans 2019 Purchase Refinance Homel Refinance Mortgage Mortgage The Borrowers

12 Month Introductory Rate Special P N Bank The Borrowers Home Loans Personal Loans

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

47 000 Gone Major New Mortgage Rules From Monday

How Much Can You Borrow For A Mortgage Hotsell 50 Off Www Ingeniovirtual Com

Borrowing Power Calculator Sente Mortgage

Simple Loan Calculator Credit Karma

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Free Printable Loan Agreement Form Form Generic

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite

Ww7onplf S1ckm

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

How Much Can I Borrow Home Loan Calculator

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips

Lvr Borrowing Capacity Calculator Interest Co Nz

Secured Loan Calculator Flash Sales 57 Off Www Ingeniovirtual Com